SMBC Group’s updated climate policy still not aligned with 1.5℃ target: NGO shareholders continue climate shareholder proposals

On May 13, Sumitomo Mitsui Financial Group (SMBC Group) announced “Strengthening Efforts against Climate Change” and “Opinion of SMFG’s Board of Directors on Shareholder Proposals”.

In April 2022, environmental NGOs submitted shareholder proposals calling for SMBC Group to strengthen its climate change measures. The NGOs have been engaging with the company for several years. Although its strengthened policy is the result of these efforts, it is still insufficient to meet the 1.5℃ target of the Paris Agreement. We will continue to ask other shareholders to support our proposals for strengthening the company’s management of climate-related risks.

Eri Watanabe, Senior Campaigner of 350.org Japan, said;

“We welcome some progress made in the recent revised policy by SMBC Group in response to previous dialogues and the shareholder proposals. However, the new policy is not seen as Paris aligned and is still far behind its overseas peers. 2030 targets for the power sector are insufficient and there is no short-term target in line with the latest climate science. Ending support for new oil and gas as called for in IEA ‘s Net Zero Emissions scenario is missing, and loopholes in its coal sector policies remain. Through continuing shareholder proposals, we will encourage the company to mitigate the climate-related risks and strengthen its climate goals and measures.”

In addition to revising its policy, SMBC Group has also announced a statement against NGOs’ and individual shareholders’ shareholder proposals related to climate change. Below is our response to these statements. Despite claims to already be promoting initiatives outlined in the shareholder proposals, SMBC’s current measures are insufficient to meet the goals of the Paris agreement.

If the SMBC group is “earnestly” working on climate action, there is no reason for them to refuse to add the shareholder proposals to their article of incorporation. By adding them, the company can appeal to the national and the global market as one of the leading financial institutions that work to tackle climate change.

Our analysis of updated SMBC climate policy

Problems with SMBC Group’s updated policy and target

(1) Coal-fired power generation

SMBC group’s updated phase-out target for coal-fired power generation falls short of consistency with the Paris Agreement goals articulated in the following.

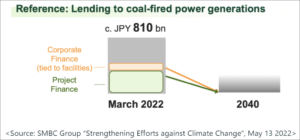

It is a step forward that SMBC Group added corporate finance tied to facilities for new or expansion of existing coal-fired power generation (equivalent of JPY 80bln) in the current coal power phase-out target (project finance equivalent of JPY 300bln). However, loopholes remain in other “lending to coal-fired power generation” (JPY 430bln). The lending out of the scope of this target will remain after FY2040, which is inconsistent with the Paris goals.

The timeline (FY2040) for the phase-out target itself is inconsistent with the Paris goals, as it should be by 2030 in OECD countries and by 2040 in the rest of the world, according to climate science.

As is the same with other Japanese megabanks, loopholes remain with unproven technologies such as CCUS, ammonia and hydrogen co-firing technologies that can contribute to prolonging the life of existing coal plants and delaying decarbonization.

(2) Coal mining

SMBC Group’s updated coal mining policy goes ahead of other Japanese megabanks, but a significant loophole remains, as described below.

Unlike MUFG and Mizuho, which only ruled out financing for new coal mining projects, SMBC Group’s new policy ruled out both new and expansion of existing thermal coal mining projects and infrastructure developments dedicated to such projects.

However, there is no provision for corporate finance in the coal mining sector policy. We are concerned that the company can still provide finance to pure-play coal mining companies such as White Haven of Australia and Adaro Energy of Indonesia. Mizuho’s updated policy, published on May 17, 2022, bans transactions with new clients whose primary businesses are coal-fired power generation or coal mining.

(3) Mid-term (2030) target for the power sector

SMBC Group announced a mid-term (2030) financed emissions reduction target in the power sector in the form of a carbon intensity target (138-195gCO2e/kWh). It claims that these targets are consistent with the IEA’s 1.5℃ and 2℃ scenarios. However, an absolute target is necessary to meet the Paris goals. The company can fulfill the intensity targets while increasing its financing for the fossil fuel power sector and GHG emissions, which is inconsistent with the Paris Agreement. In addition, the target only applies to lending and not to investment and underwriting. The target should cover the overall financing and investment portfolio as the company has committed to net-zero emissions in its “overall loan and investment portfolio by 2050”.

(4) Commitment to set a mid-term (2030) target for the energy sector

The company has disclosed its financed emissions from the energy sector (oil, gas, and coal) as 87.6 MtCO2e (absolute emissions), covering approximately 70% of its portfolio. The company committed to announcing its 2030 targets in the energy sector in August 2022 and improving its portfolio coverage. However, there is no assurance that the company’s new target will be consistent with the Paris trajectory.

The scope of this target seems to be limited to “upstream businesses”[1], and fossil fuel infrastructure such as oil and gas pipelines, LNG terminals, and oil and gas power plants are out of its scope. The policy will apply to lending and not investment and underwriting. SMBC Group still has no policy to restrict financing for new oil and gas development and is inconsistent with the IEA’s net-zero scenario and the Paris goals.

Our response to “Opinion of Sumitomo Mitsui Financial Group’s Board of Directors on Shareholder Proposals”

In addition to revising its policy, SMBC Group has also announced a statement against NGOs’ and individual shareholders’ shareholder proposals related to climate change. Below is our response to these statements.

(1) The company’s current measures are insufficient to meet the Paris goals

- The company claims it is “already promoting initiatives related to what this shareholder proposal seeks (implementation of loans and investments aligned with the goals of the Paris Agreement) as part of its management policy” and that “while supporting the Japanese government’s policy, SMBC Group work earnestly to reduce GHG emissions in line with the goals of the Paris Agreement”. However, its initiatives and policies are insufficient in light of 1.5 degrees trajectories.

- The Japanese government’s climate policy and actions, including net-zero by 2050 and a 46% reduction target in 2030, are evaluated as “insufficient” by climate scientists [2]. The company needs to strengthen its policy and actions beyond what the government has committed.

- If the company is “earnestly” working on climate action, there is no reason for them to refuse to add our proposals to their article of incorporation. By adding them, the company can appeal to the national and the global market as one of the leading financial institutions that work to tackle climate change.

(2) The amendment of the Articles of Incorporation is the only way climate-related resolutions can avoid being rejected under Japan’s law

- The company stated, “the Articles of Incorporation stipulate fundamental policies in the operation of a company, and therefore is inappropriate to stipulate matters concerning individual and specific business execution” and that our proposals fall into such cases. However, in light of the Companies Act of Japan, this is the only way shareholder proposals can avoid being rejected by the company as unlawful.

(3) Provisions in our proposals are fundamental policies that do not change very frequently

- The company explained, “Changes to the Articles of Incorporation require a special resolution at the General Meeting of Shareholders, therefore, if this proposal is approved, it will make it difficult for the Company to respond and adjust flexibly.” However, it is unclear what kind of flexible responses and adjustments are difficult to make by the company. Our proposals stipulate a broad framework that requires disclosure of business plans, including short and mid-term targets consistent with the Paris goals and lending consistent with the net-zero emission scenario, which is not subject to change very frequently.

- Given the increasing certainty of scientific findings by the Intergovernmental Panel on Climate Change (IPCC), it is clear that a direction towards net-zero is necessary and our proposals are consistent with the SMBC Group’s own 2050 net-zero target.

Reference

- SMBC Group, “Strengthening Efforts against Climate Change” News Release: May 13, 2022

- SMBC Group, “Strengthening Efforts against Climate Change” Full Documents: May 13, 2022

- SMBC Group, “Opinion of SMFG’s Board of Directors on Shareholder Proposals”: May 13, 2022

- “Press Release: Corporate Japan faces record number of climate shareholder resolutions” April 13, 2022

Footnote

SMBC Group states that the term “upstream business” also includes “integrated oil and gas companies”. Although the details and the company’s definition of “upstream” are not clear, the stages from resource exploration, development, and production in the fossil fuel business are generally referred to as “upstream”, while the stages of refining, marketing, and transportation of the produced fossil fuel are called “downstream”.

Climate Action Tracker, an international group of climate researchers, rates the Japanese government’s overall climate policy as “insufficient” (as of Feb 10, 2022) , including the path to achieving Net Zero in 2050 and 2030 target of reducing greenhouse gas emissions by 46-50% from 2013 levels.

Contact

350.org Japan

Drue Slatter drue.slatter@350.org

Eri Watanabe japan@350.org